- Apple faces complex regulatory hurdles in China for its AI deployment.

- Officials push for mandatory local partnerships.

- Cupertino resks market share in China, which represents 17% of its revenue.

Just three months ago, Apple’s launch of the iPhone 16 met with little enthusiasm in the Chinese market, as consumers hoping for AI features found themselves disappointed. The muted reception was particularly stark when contrasted with Huawei’s strategic counter-punch—launching its own AI-powered device mere hours after Apple’s announcement, complete with sophisticated artificial intelligence (AI) capabilities up and running, somthing that Apple couldn’t yet offer in the region.

As Apple seeks to launch its AI features in China, the tech giant is discovering that even having a trillion dollars doesn’t mean it can easily penetrate Beijing’s regulatory firewall. The company’s struggles in China expose a broader challenge facing Western tech companies: navigate the complex maze of Chinese AI regulations or risk being left out of one of the world’s most lucrative markets.

The stakes are high for Apple. With China accounting for 17% of its total revenue last year and an 8% decline already recorded amid rising competition from Huawei and Chinese manufacturers, the pressure to maintain market relevance is intense. Yet, the path forward is anything but straightforward.

The Cyberspace Administration of China’s stance is unambiguou: foreign companies must partner with local entities for AI service provision, systems that have had their LLMs approved by the authorities. Otherwise, the companies like Apple will have to wait for approval of their different back-end models. This message echoed clearly through the corridors of the recent World Internet Conference in Wuzhen.

Tim Cook’s third visit to China this year, meeting with Premier Li Qiang, underscores how seriously Apple is taking the issue. Apple has begun discussions with potential local partners like Baidu, ByteDance, and Moonshot. Negotiations, therefore, represent more than mere business dealings – they’re a testament to China’s growing technological autonomy and its determination to maintain control over AI development within its borders.

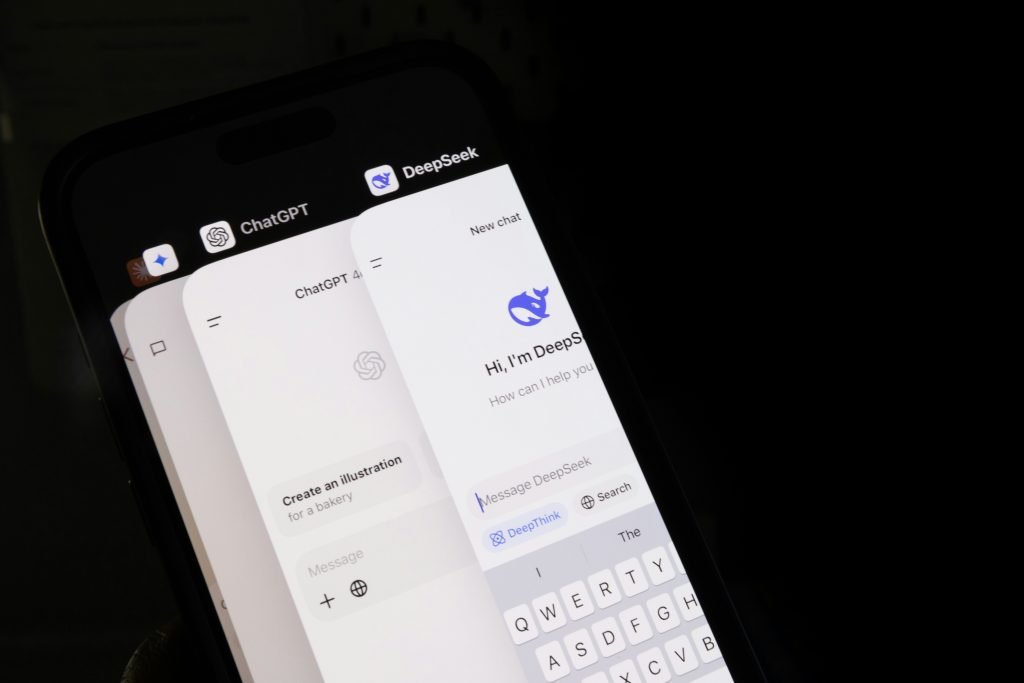

Industry observers are quick to see the irony. Apple, a company that prides itself on vertical integration and maintaining strict control over its ecosystem, must now consider ceding some of that control to Chinese partners. The company has successfully rolled-out of Apple Intelligence (AI) features in the US and other regions since October, using its own infrastructure and OpenAI’s ChatGPT, in stark contrast with the compromises it will need to make in China.

JP Morgan analyst Samik Chatterjee’s projection of a potential delay until the second half of 2025 without local partnerships isn’t just a timeline – it’s a warning. The longer Apple takes to navigate the regulatory waters, the more ground it cedes to domestic competitors like Huawei, which has already integrated AI capabilities into its latest smartphones.

Beyond the business implications lies a more fundamental question: What happens when Western innovation meets Chinese regulation? Apple’s predicament exemplifies the growing tension between global tech ambitions and national digital sovereignty. The requirement to use pre-approved large language models from Chinese firms isn’t just about regulatory compliance – it’s about data control, technological independence, and, ultimately, political power.

For Apple, the choice ahead is clear yet complicated: partner with local firms and potentially compromise on its AI features’ independence or risk losing ground in a market crucial to its global success. This isn’t just Apple’s dilemma; it’s a preview of the challenges that await any Western tech company hoping to deploy AI solutions in China.

As the situation unfolds, one thing becomes certain: the era of seamless global tech deployment is giving way to a more fragmented digital world, where national boundaries increasingly define the limits of technological innovation. Apple’s journey through China’s regulatory landscape may be the start of the chapter in future history books describing how global tech companies became local technology businesses.