- Despite DeepSeek’s more efficient AI model, tech giants double down on AI investments.

- Combined capital expenditure to reach $320 billion in 2025.

- Tech CEOs argue that cheaper AI technology drives higher demand.

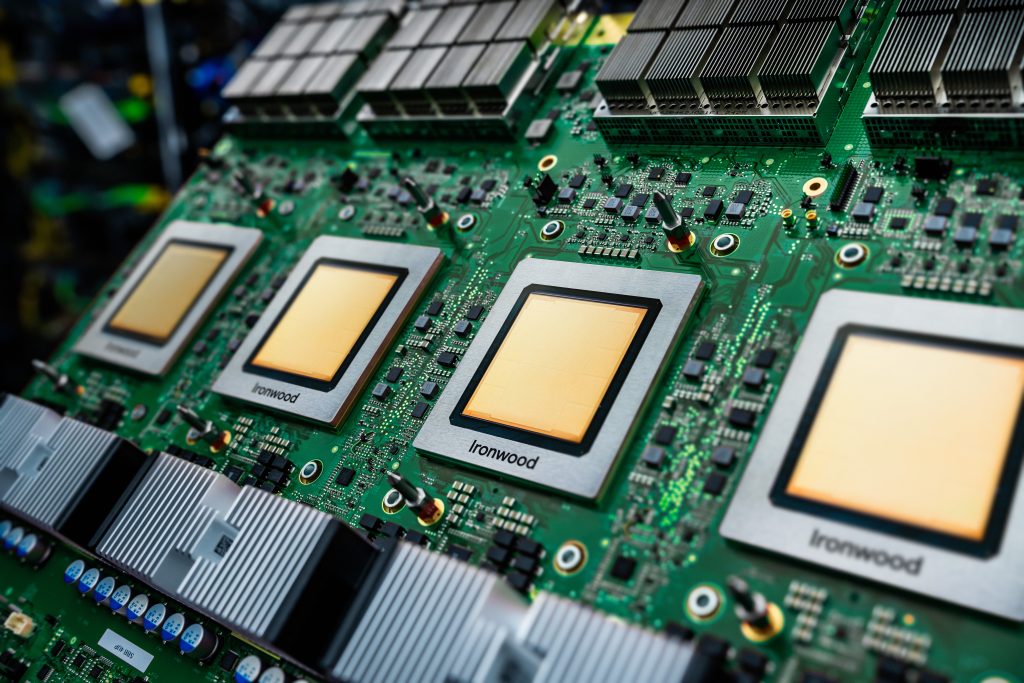

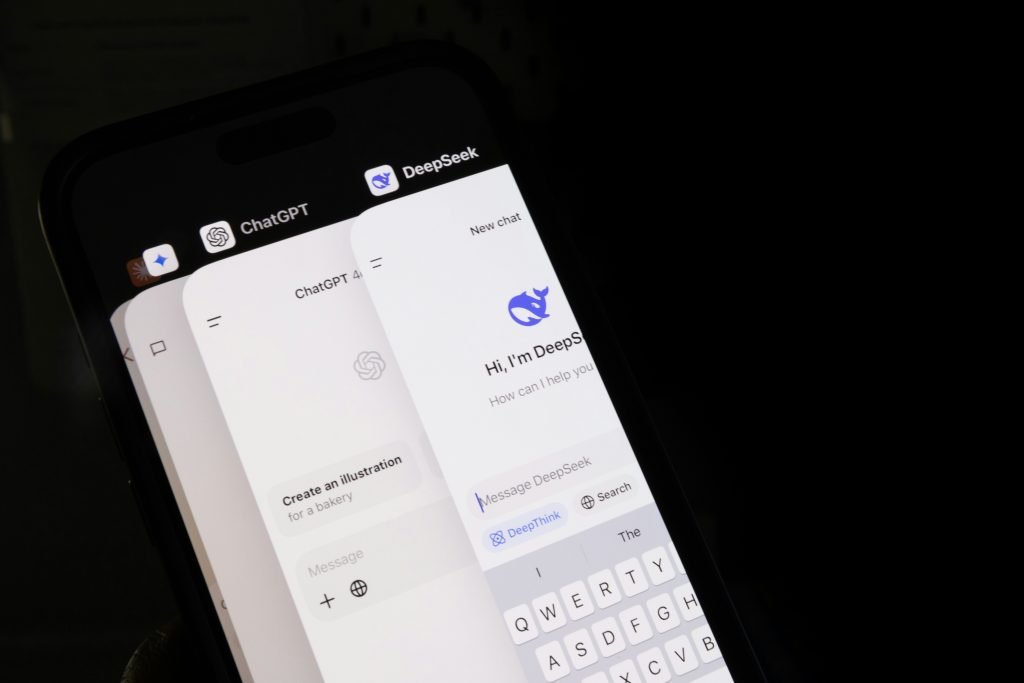

The AI investment surge among tech giants shows no signs of slowing. Amazon, Microsoft, Google, and Meta still appear to be planning investment of over $320 billion in AI infrastructure by 2025, even as Chinese startup DeepSeek demonstrates potentially more efficient AI model development methods.

The unprecedented level of capital expenditure, up from $246 billion in 2024, reflects Big Tech’s conviction that AI represents a transformative opportunity, one that justifies massive infrastructure investment. The spending plans persist despite investor concerns about DeepSeek’s recent claims that it can train and operate significantly more efficient AI models.

Amazon is leading the investment. The company plans to allocate over $100 billion in capital expenditures this year, marking a significant increase from $77 billion in 2024. The company’s CEO, Andy Jassy, defended the aggressive spending strategy during a recent earnings call, characterising AI as a “once-in-a-lifetime type of business opportunity” for Amazon Web Services (AWS).

Microsoft is also positioning itself as a major contender in the AI cloud race, and has earmarked $80 billion for AI-related infrastructure in 2025. CEO Satya Nadella points to compelling evidence supporting the investment strategy, noting that Microsoft’s AI business “has surpassed an annual revenue run rate of $13 billion, up 175% year-over-year.”

Nadella’s perspective on AI demand draws from the Jevons paradox – the economic observation that increased efficiency in resource use leads to higher, not lower, consumption. “As AI gets more efficient and accessible, we will see its use skyrocket, turning it into a commodity we just can’t get enough of,” Nadella stated in a recent social media post.

Google’s parent company, Alphabet, has also adopted on aggressive stance, planning approximately $75 billion in capital expenditures for 2025, significantly exceeding analysts’ expectations of $58 billion. Despite concerns about the company’s AI strategy and slowing cloud growth, CEO Sundar Pichai maintains that Google is “building, testing, and launching [AI] products faster than ever.”

Meta’s approach to the AI investment surge stands out. The company plans to spend $60-65 billion on capital in 2025, up from $39 billion in 2024. The company’s strategy of pursuing an “American standard” for open-source AI models has resonated with investors, particularly given Meta’s demonstrated ability to monetise AI through advanced ad targeting.

Industry analysts are divided over the impact of DeepSeek’s developments on Big Tech’s AI investments. Jesse Cohen, senior analyst at Investing.com, voiced investor concerns about the need for “clearer timelines on when AI spending translates to earnings and sales growth, not just promises.”

However, Dan Ives, managing director at Wedbush Securities, dismisses DeepSeek as a serious threat to Big Tech’s AI ambitions. “This is an AI arms race, and the Temu of AI DeepSeek is not changing that… [The] AI Revolution [is] just starting.”

The persistence and continued growth of AI investment suggests that significant technology companies view DeepSeek’s efficiency gains as a catalyst for broader AI adoption rather than a threat to their infrastructure investments.

The market response to the massive levels of investment has been mixed. While Meta’s proposed investments in AI have been well-received (shares rose following its earnings call), other technology firms have faced more sceptical investors. After announcing its spending plans, Amazon’s stock fell more than 5%, while Alphabet’s share value dropped more than 8% after its earnings report announcement.

Despite the market’s reactions, technology leaders remain convinced that AI investment represents a strategic necessity rather than an optional luxury. As the industry continues to evolve, the race to build AI infrastructure is intensifying rather than slowing, suggesting that DeepSeek’s developments may indeed be accelerating, not dampening the industry’s AI ambitions.