- Ryt Bank aims to address financial gaps in Malaysia.

- Bank simplifies transactions and broadens access to digital services.

The Ministry of Finance (MoF) has approved a digital banking licence for YTL Digital Bank Berhad, a joint venture between YTL Digital Capital Sdn Bhd and Sea Limited. The bank, known as Ryt Bank, has been cleared to begin operations on December 20, 2024. To ensure a smooth transition, it will be introduced to the public in phases.

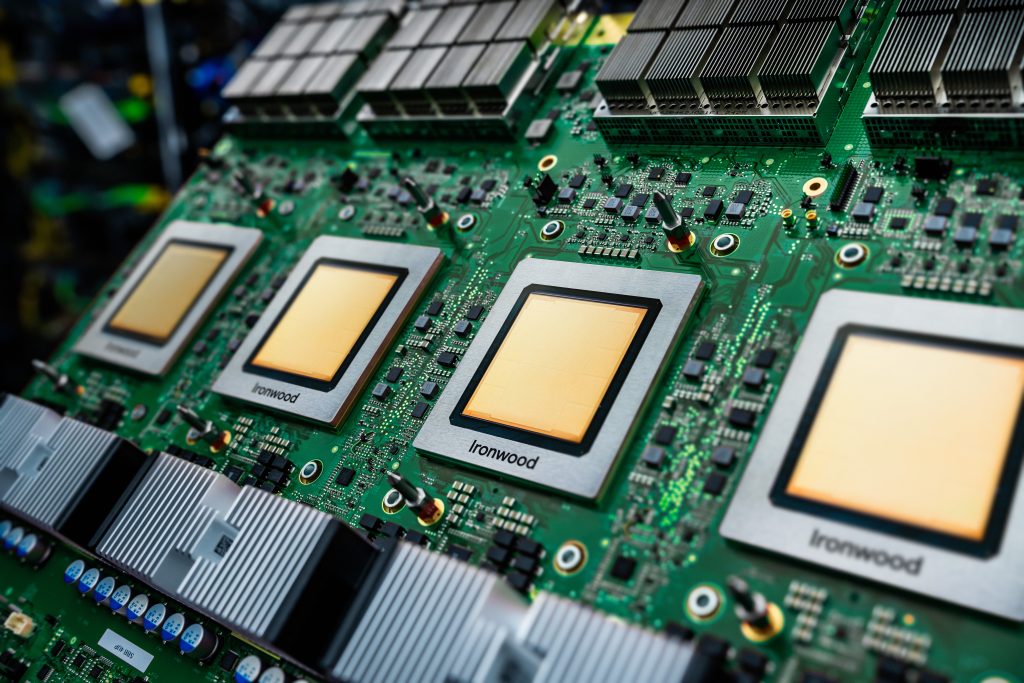

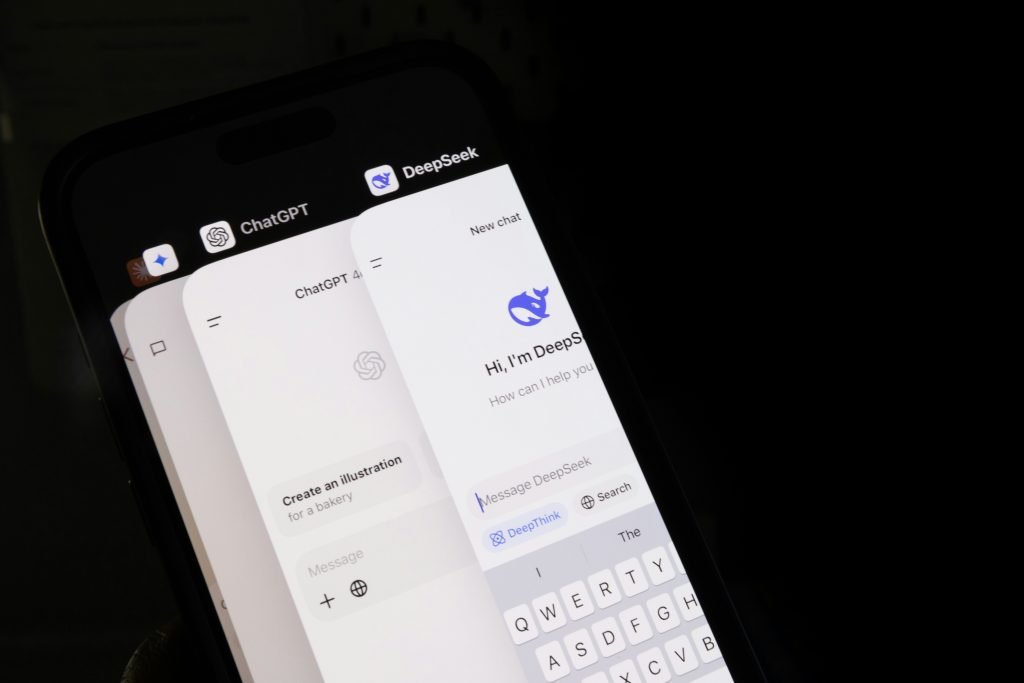

Melvin Ooi, CEO of Ryt Bank, acknowledged the regulatory approval, calling it a step forward for Malaysia’s digital banking industry. He said that the bank will use AI to create a more accessible and inclusive banking experience. “By harnessing the power of AI to provide an unparalleled customer experience, we aim to deliver financial services that are meaningful and inclusive while helping customers achieve their financial goals,” he said.

The use of AI and machine learning (ML) in financial services is not new, and Ryt Bank wants to harness the technology to simplify processes. AI/ML techniques can help financial service providers (FSPs) make better decisions, manage risks more effectively, and improve efficiency while reducing costs. The capabilities align with Ryt Bank’s commitment to enhancing accessibility and the user experience.

Malaysia is witnessing a growing adoption of AI/ML in its financial sector. A 2021 survey conducted by Bank Negara Malaysia (BNM) on AI/ML adoption among 25 financial service providers – including banks, insurers, and payment operators – revealed that many FSPs are actively using these technologies. The survey highlighted common applications like customer analytics, digital onboarding, and e-KYC processes. Some institutions have also incorporated AI/ML into credit underwriting, enabling more precise risk assessments and expanding access to underbanked customers.

The survey found strong support for AI/ML adoption at the senior management and board levels of these organisations. About half of the respondents viewed AI/ML as a ‘game changer’, with many exploring opportunities beyond existing use cases and current projects. That context sets the stage for Ryt Bank’s efforts to integrate advanced AI/ML tools into its operations.

Ryt Bank emphasises its Malaysian roots and seeks to simplify banking for its customers with an AI-powered platform. Its tools are designed to streamline processes like onboarding and transactions, offering a more personalised experience by analysing customer behaviour to better understand their needs.

At the core of Ryt Bank’s services is Ryt AI, an AI-based assistant intended to make financial management more straightforward. It claims to provide tailored financial advice, help customers develop savings strategies, and offer 24/7 support. One key feature of Ryt AI is its ability to complete fund transfers with a single text input, designed to save time and accommodate users with diverse needs and languages.

Security is another key focus for Ryt Bank. The bank employs encryption, biometric face verification, and real-time fraud monitoring to help safeguard its customers. Deposits are insured by PIDM up to RM250,000 per depositor, and the bank’s no-hidden-fee policy aims to show a commitment to transparency.

The initiative hopes to address the gap in financial access in Malaysia. Around 15% of the population remains under-served by the sector. Ryt Bank plans to provide services tailored to this group, contributing to the country’s broader financial inclusion efforts.

The collaboration between YTL and Sea brings together the strengths of two established organisations. YTL brings decades of experience in infrastructure and development, while Sea contributes expertise through enterprises like Shopee and SeaMoney. Together, they aim to create a banking experience that is suited to Malaysia. Ryt Bank is expected to launch its services to the public in the coming months, introducing a new player to Malaysia’s digital banking sector at a time when financial accessibility and innovation are growing priorities.

Want to learn more about AI and big data from industry leaders? Check out AI & Big Data Expo taking place in Amsterdam, California, and London. The comprehensive event is co-located with other leading events including Intelligent Automation Conference, BlockX, Digital Transformation Week, and Cyber Security & Cloud Expo.

Explore other upcoming enterprise technology events and webinars powered by TechForge here.